- All Posts

- Inflation Reduction Act: Low-Income Bonus Credit in the Investment Tax Credit

Inflation Reduction Act: Low-Income Bonus Credit in the Investment Tax Credit

Diving into the details of the legislation to help you understand your options.

The Inflation Reduction Act creates significant opportunities for building owners to ready their operations for long-term resiliency and eliminate deferred maintenance, realize cost savings, accelerate decarbonization and reach equitable outcomes for generations to come.

McKinstry Federal Funding Strategist Sara Berry Maraist explains the Low-Income bonus credit in the Investment Tax Credit (ITC):

Credit Overview

The Low-Income credit is a competitive 10-20% bonus credit that only applies to wind and solar projects under 5 megawatts.

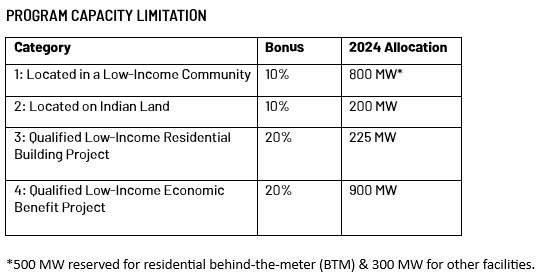

There are four eligible categories that a project may qualify for. Each category has its own bonus credit percentage and total capacity limitation that is available for each year:

For Low-Income Communities, the DOE’s Category 1 map tool can be used to determine if your project is within a low-income census tract.

A project can only apply for one of the above categories, even if the project qualifies under multiple. The bonus allocation must be received before a project is placed in service and the project must be placed in service within four years of receiving the allocation.

Application Overview

The annual application window will open for 30 days, during which all applications submitted will be treated as submitted on the same day, and on a rolling basis thereafter. For each program year, 50% of the Capacity Limitation of each category is reserved for Additional Selection Criteria (ASC). Projects will receive priority if they meet one of the ASC and they may receive additional priority if they meet both ASC. The IRS will issue an award or denial letter to confirm allocation.

Additional Selection Criteria is comprised of two categories: Ownership criteria and geographical criteria.

- Ownership Criteria:

- At least 51% ownership by:

- a Tribal enterprise,

- an Alaska Native Corporation,

- a renewable energy co-op,

- a qualified renewable energy company (i.e. serves low-income communities), or

- a qualified tax-exempt entity (i.e. 501(c)3, 501(d), any state or territory, Tribal government, or 501(c)12).

- Geographical Criteria:

- located in a Persistent Poverty County (PPC), or

- located in a disadvantaged community per the Climate and Economic Justice Screening Tool (CEJST). Note: The DOE Category 1 Map Tool includes PPC & CEJST data to show if project qualifies for the ASC.

McKinstry is prepared to be your partner and support you in determining if your project qualifies under the Low-Income bonus credit.

For more information and resources, please visit our IRA blog or contact us below.

Interested in Learning More?

Please complete the required fields below to learn more about how McKinstry can help your organization achieve its sustainability goals.

Financial Disclaimer: McKinstry is not engaged in providing legal, tax or financial advice. The information provided herein is intended only to assist you in your decision-making and is broad in scope. Accordingly, before making any final decisions you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your specific circumstances.

Explore Other Insights

Delivering 100+ Energy Audits Across Washington

When Washington State introduced its Clean Building Performance Standards, public-sector building owners faced a sign…

Constant Curiosity and Connection: Cass Young’s Journey a…

From supply chain to project engineering, Cass Young has built her career at McKinstry by staying curious, embracing …

AI’s Shadow Footprint: What Smart Infrastructure Needs to…

Every advancement in artificial intelligence carries a physical consequence: more computation, more heat and more pow…